McCaskill Abstains

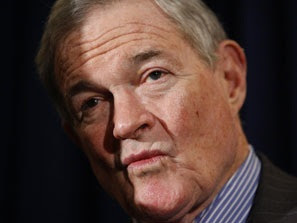

McCaskill AbstainsSen. Kit Bond was one of just two Senators voting against an amendment that could pave the way for the federal government to extend unemployment benefits.

The vote to invoke cloture was 85-2. That is well above the 60 needed to limit amendments and move the legislation toward a final vote, which is likely later this week. It provides up to 14 additional weeks of unemployment benefits.

HERE's the vote breakdown.

BUT: The Associated Press notes the vote also effectively blocked Republicans from trying to terminate at year's end the financial rescue plan known as the Troubled Asset Relief Program, or TARP. The GOP is arguing that Democrats are using unspent TARP money as a slush fund to pay for programs unrelated to financial stabilization. Republicans also cried fowl about a move to cut off debate and not allow votes on amendments.

The legislation also includes an extension of the $8,000 first-time home buyer tax credit, that is set to expire. On Monday, Bond's office said the senior Senator was wary of extending that benefit because of widespread fraud, cited by the Inspector General.

"According to the Brookings Institution, the vast majority of home-buyers who used the credit would have bought a home without it and at best, the credit simply brought forward home sales that would have occurred in the future. The Brookings Institution estimates that only 15 percent or 350,000 sales were directly attributable to the tax credit," said Bond in his floor speech. "For the vast majority of cases, the home-buyer tax credit amounted to a free gift since it did not affect their decision to purchase a home," he added.

No comments:

Post a Comment